Table of Content

Credit Report Huntington will obtain a credit report showing your credit history. If your credit report shows a late payment or default, you may be required to provide a written explanation of why it occurred. If you have declared bankruptcy in the past, you may be required to furnish copies of the official bankruptcy documents and a written explanation of why the bankruptcy occurred. Huntington offers fixed rates and 10 years of access on their home equity line of credit , which taps into your equity without taking out a conventional loan. To benefit our customers, we offer our Low Down Payment Purchase Mortgages without requiring the Private Mortgage Insurance that most other banks charge for mortgage loans with less than 20% down. You do not need pre-approval for your home loan, and not all lenders offer pre-approvals.

Heather previously worked as a technical writer and editor for the casino systems industry and is an internationally published young adult mystery author. She holds a bachelor’s degree in English with a minor in journalism from the University of Nevada, Reno. Use our free mortgage calculator to get an estimate of what your monthly payments will be for your home loan or message us to get your mortgage pre-approval today! Secure Funding Group are your Huntington Beach mortgage brokers.

Home Loan Pre-Approval Explained

If you're pre-approved, share your letter from Huntington with your realtor. Huntington National Bank has been accredited with the BBB since 1921 and, as of July 2022, has an A+ rating. The bank has closed 1,050 official complaints in the last three years, with 432 closed in the last 12 months.

complete

We always find a means to get you approved and financed.

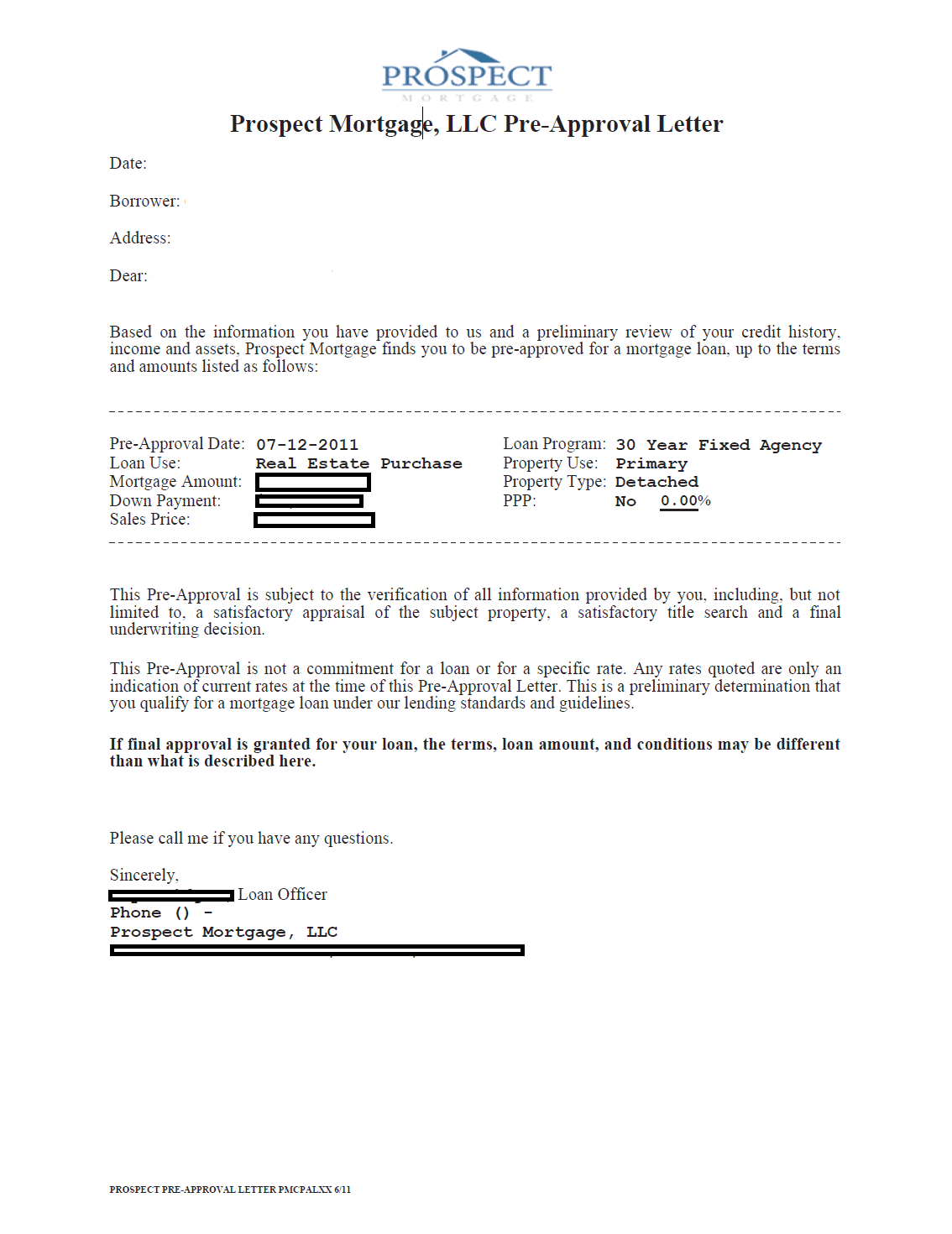

This lender works with state bond programs in the states it services to help with your down payment. Enter verification information and select whether you want to include your credit report. A home loan pre-approval will give you clear guide on how much cash you have to work with and put you in a better position to negotiate when buying a home in Huntington Beach. A home loan pre-approval will give you clear guide on how much money you have to work with and put you in a sounder position to negotiate when buying a home in Huntington Park. Pre-approval, sometimes referred to as conditional approval or approval in principle, is an indication from your lender of how much you may be able to borrow.

We didn't feel like just another number or piece of paper. A real person answers the phone when you call and we return your calls within one business day. The privacy policy of this bank does not apply to the website you visit. We suggest that you always verify information obtained from linked websites before you act upon such information. Information on linked website pages may become dated or change without notice, and we do not represent or warrant that information contained on these linked pages are complete or accurate.

Mortgage guides

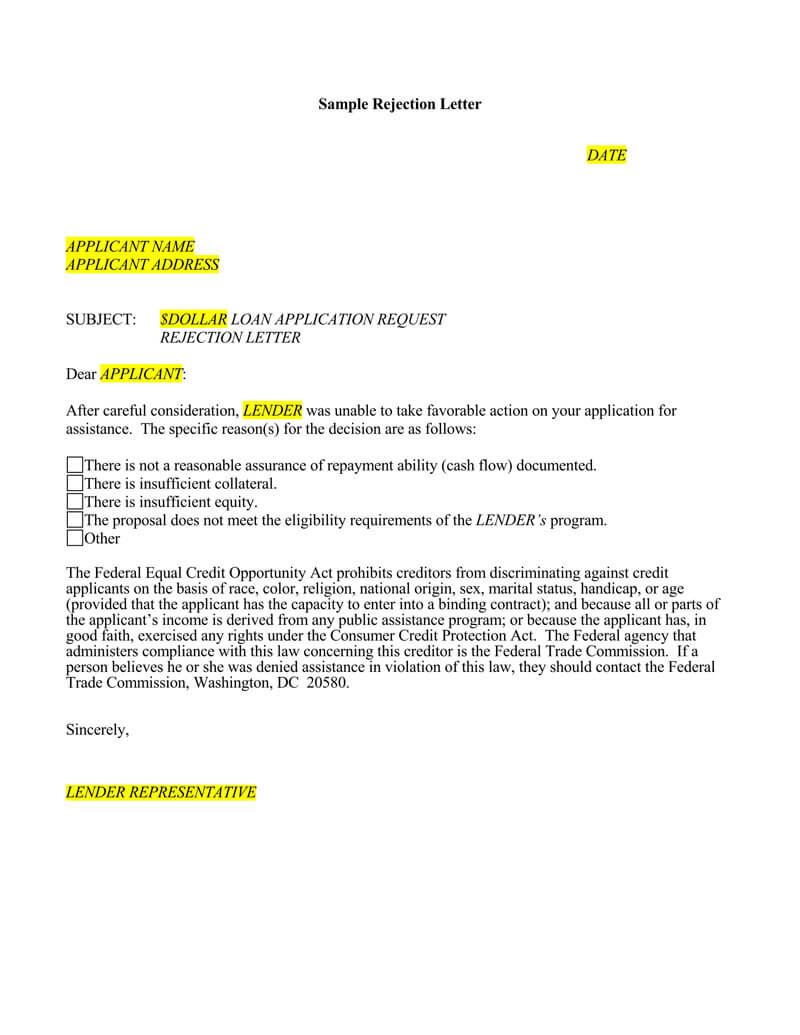

Please appreciate that there may be other options available to you than the products, providers or services covered by our service. Huntington doesn’t state minimum credit requirements, but 620 is the minimum credit score required by most lenders for a conventional loan. Huntington National may be an attractive option to borrowers who like the idea of a smaller regional bank but want to choose from a variety of loan types. The bank has some great online educational tools, but the rate quote and preapproval tools are really just contact forms that make you wait for a call back from a loan officer to get any personalized information. Borrowers looking to do more research online or who live outside the bank’s seven-state footprint will want to shop around to find a better fit. Huntington National Bank is a midwestern regional bank that offers most standard loans, as well as some specialized loans and services to help keep your mortgage costs down.

You do not have to have found the house you intend to buy. Rather, pre-approval can help you to narrow your search and eventually place an offer with confidence. You'll pay a $185 filing fee when you get your loan and Huntington will also hit you with $35 late fee after a 10 day grace period. Use our Rate Calculator to find the rate and monthly payment that fits your budget.

But you must speak to a loan officer in person or over the phone for fees and rates. Reduce your monthly payments or cash out your equity with waived application fees and discounts on closing costs. Payment reductions are for illustration purposes only and assume you make your home loan payment on time. Your actual payment reduction may vary depending on the APR and term of your home loan, the actual terms of your credit accounts, and how you make payments on those accounts. Taking cash out in addition to consolidating debt will increase your monthly payment. Your actual APR may be higher or lower than the APR shown here, which is based on APRs available as of the date of this communication and creditworthiness.

Our information is based on independent research and may differ from what you see from a financial institution or service provider. When comparing offers or services, verify relevant information with the institution or provider's site. While the bank has Get a Quote Now buttons on almost every loan page, the tool is really only a glorified contact form to put you in touch with a loan officer. Lauren Claxton is a freelance writer with a focus on personal finance and cryptocurrency. She has previously written for Crypto News Australia and was employed as a content writer at Monzi Personal Loans.

Property Appraisal - A property appraisal is a basic requirement for almost any mortgage loan. An appraisal is an estimate of a property's value as of a given date as determined by a qualified professional appraiser. Huntington usually selects who will appraise the property and orders the appraisal.

I have already referred a friend and family member to them. Thank you so much for creating a great experience for me. If there's any advice I could give someone it would be to not use a large bank for your lender... Secure Funding group was a completely different experience.

Because the lender will check many of those financial requirements again, when you get closer to closing day. With mortgage rates this low, home buyers are wondering whether this trend will continue. Main Benefits of a home equity loan or mortgage refinancefrom Discover may include lower interest rates and ZERO charges at closing. Since a home equity loan or refinance is a secured debt, the average interest rate is typically lower than what you'll pay on an average credit card or other form of unsecured debt. With Discover, you will not have to pay any application fees, origination fees, or appraisal fees.

Loan Estimate - This form presents an itemized estimate of the costs you will incur at closing as well as estimated information on your Annual Percentage Rate and cost of financing. At Huntington, we make this possible by minimizing the documentation you'll need to provide. The following checklist shows what is required to review your loan. Huntington’s website has an extensive library of mortgage information as well as calculators and checklists to make sure you know what to expect and how to make decisions about the best loan for you. Connect with vetted lenders quickly through this free online marketplace. Preapproval in minutes and closing in as little as 3 weeks with no origination fees.

That’s how important this first step in your home-buying journey is, and we want to help you take it. Because of the bank’s size, there aren’t many customer reviews outside of the BBB, which has 277 reviews and a rating barely over 1 star. Medical professionals can get home loans with no down payment, no mortgage insurance and no prepayment penalties. Our promise is to make your application and approval process the best mortgage experience ever. Our commitment is to make your application and approval process the best mortgage experience ever. Contact Huntington Federal Savings Bank for specific eligibility requirements and guidelines.

Based in Brisbane, her goal is to make the financial world easily comprehensible, particularly for the younger generations. Pre-approvals from most financial institutions are only applicable for three to six months. After this period, if you still have not found your dream home, you will have to apply again. Ensure you confirm the validity period of your pre-approval with your lender. Large financial commitments, like property, can be both exciting and intimidating – particularly for first home buyers. Luckily, home loan pre-approval may help you to put your best foot forward.

No comments:

Post a Comment